By Bill WilsonBusiness reporter, BBC News

These are external links and will open in a new windowShare this with Facebook Share this with Twitter Share this with Messenger Share this with Email Share

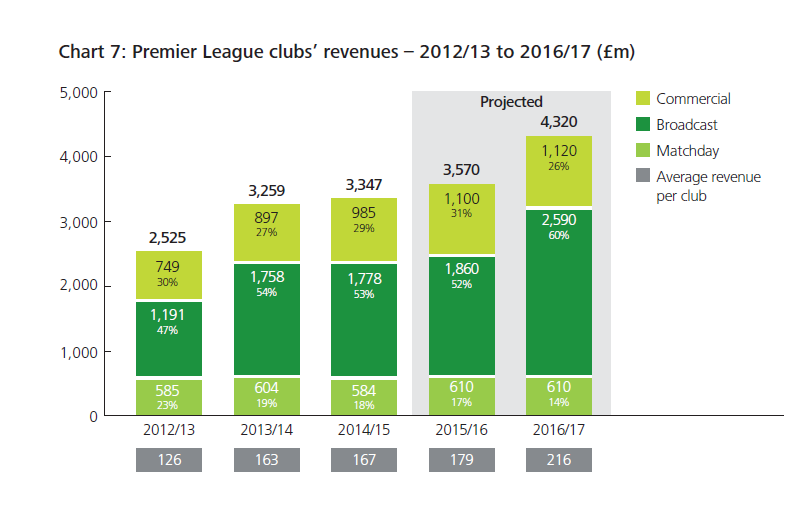

Buoyant Uefa TV income helped Premier League clubs’ revenues rise 9% to a record £3.6bn in the 2015-16 season, according to analysis from Deloitte.

It says broadcast earnings of £1.9bn accounted for more than half of the top flight clubs’ total revenues.

A new domestic TV deal which kicked in last year means overall revenues continue to grow strongly, it added.

For a third straight season, clubs’ combined operating profits exceeded £500m, but wages rose 12% to £2.3bn.

“Even in the final year of its old broadcast contracts, Premier League revenues continued to set new records,” said Dan Jones, partner in Deloitte’s sports business group, which has unveiled its latest Annual Review of Football Finance.

He said the broadcasting boost to revenues in 2015-16 was mainly down to European federation Uefa increasing its payments to Premier League clubs by £100m.

European football finances 2015-16 season key facts

Total European football market revenues reached 25bn euros (£22bn) in 2015-16, a 13% increase on 2014-15The increase was driven by growth in broadcasting rights’ values in Europe’s biggest leagues, plus impact of Euro 2016All “big five” leagues – England, Italy, Germany, Spain, France – saw revenues increase from the previous season”Big Five” collective revenues rose 12% to a record 13.4bn eurosPremier League clubs spent a record £1.3bn on transfers, surpassing the previous season’s record by more than 20%.

Deloitte Annual Review Football Finance 2017of

Mr Jones said Premier League clubs were now reaping the benefit of a new broadcast rights cycle which started in 2016-17, plus new commercial agreements, and match day revenue growth from new and expanded stadia.

Deloitte says it now expects total Premier League clubs’ revenues to be more than £4.5bn in 2017-18.

Meanwhile, Premier League net debt fell for the third consecutive season, by £125m (5%) to £2.2bn at the end of the 2015-16 season.

However, while Premier League clubs returned to a collective pre-tax loss in 2015-16. Deloitte said this was the result of exceptional, or one-off, accounting adjustments, without which clubs collectively would have broken even.

One example of these one-off adjustments was Chelsea making a big financial provision to cover the cost of the early cancellation of their kit deal with Adidas.

“We fully expect that Premier League clubs will collectively achieve record levels of profitability in the seasons to come,” said Mr Jones.

Are Championship clubs gambling on player pay?

In the Championship, overall revenues increased to a new record level of £556m in 2015-16, and have risen by 74% in the past decade.

But for the third time in four years, clubs spent more on wages (£561m) than they generated in revenue, resulting in a record operating loss of £261m. This follows two seasons where losses have been reduced.

Clubs in the Championship stand to see their revenues jump by at least £170m from promotion to the Premier League, rising to over £290m if they survive one season.

But Deloitte says there there is a danger that Championship clubs may continue to be tempted “to spend excessively relative to their revenues, particularly on wages”.

Former Chelsea captain John Terry has signed for Aston Villa on a reported £60,000 a week, plus further cash incentives should they win promotion

Yet Deloitte points out that Huddersfield Town’s promotion at the end of the 2016-17 season shows any Championship club can reach the Premier League, regardless of their budget. And they point out that in 2015-16 Huddersfield had the Championship’s fourth-lowest wage costs.

Celtic on top

Including Football League clubs, the top 92 professional teams in England generated a record £4.4bn in revenue in 2015-16, Deloitte said.

The 92 clubs contributed £1.6bn to UK government in taxes in 2015-16, up from £1.5bn the year before.

In Scotland, despite Celtic’s failure to qualify for the Uefa Champions League group stages for the second consecutive season, Scottish Premiership clubs’ aggregate revenues grew 10% to 149m euros.

Celtic continued to generate more than 50% of total revenues as they won the league for a fifth consecutive season, and Deloitte says “their participation in the 2016-17 Uefa Champions League group stages will result in a substantial uplift in revenue”.

Football in China: Still the new ‘gold rush’?

China’s investment and influence in football has been growing in both domestic clubs’ playing squads and infrastructure, and foreign club purchases and sponsorship.

In their 2016-17 winter transfer window, Chinese Super League clubs spent more than £300m on players, including Oscar’s transfer from Chelsea to Shanghai SIPG and Odion Ighalo’s move from Watford to Changchun Yatai.

But Deloitte says some recent political moves could curtail this player spending boom.

In January, the government body responsible for regulation of sport in China said that a cap on player salaries and transfer fees would be established to control “irrational investment”.

That month, the Chinese Football Association also implemented a stricter rule allowing only three foreign players to participate for a club in a super league fixture. This replaced the previous “4 plus 1” rule which allowed four foreigners plus one (non-Chinese) Asian player in a matchday squad.

And in June 2017, the Chinese Football Association said clubs that were loss making and spent in excess of 45m yuan (c.£5m) on a foreign player must pay an amount equivalent to the excess into a national fund to develop young Chinese players.